Goldco vs Augusta Precious Metals: Side-By-Side Comparison

As more people look for smarter ways to grow their retirement funds, investing in gold and silver through an IRA has become increasingly popular. Thanks to their popularity, there are two companies that often come up in this space are Goldco and Augusta Precious Metals.

These gold investment companies have built strong reputations by focusing on clear communication, quality service, and helping investors understand their investment options.

That said, each one brings something different to the table. Their individual strengths might play a big role in which one is the better fit for you. I’ll break down their key differences based on my own experiences with both Goldco and Augusta. Hopefully, this article will help you make an informed choice.

| Feature | Goldco | Augusta Precious Metals |

|---|---|---|

| Overall Rating | 4.8 out of 5 | 4.9 out of 5 |

| Minimum Investment | No minimum required | $50,000 minimum |

| Current Promotions | Up to $10,000 in free silver on qualifying accounts | No fees for up to 10 years (terms apply) |

| Buyback Program | Yes | Yes |

| Available Metals | Gold, Silver, Platinum, Palladium | Gold, Silver, Platinum, Palladium |

| Custodian Partner | Equity Trust Company | Equity Trust Company |

| Media Coverage | Featured on Fox News, Newsmax, CNBC, and The Sean Hannity Show | Recognized by Forbes, Business Insider, and Investopedia |

| Ideal For | Investors with smaller balances | Investors with larger portfolios |

| Free Gold IRA Guide | Yes | Yes |

Insights into Goldco and Augusta

Goldco and Augusta Precious Metals are both highly trusted names in the gold IRA industry.

That said, Augusta may be the better choice for individuals planning to invest $50,000 or more. The company stands out for its white-glove customer service and a decade-long fee waiver for qualifying clients. Augusta provides detailed, ongoing support every step of the way, from setting up your account to handling rollovers.

Goldco, on the other hand, doesn’t have an investment minimum. It’s one of the most established and widely recognized companies in the space and a flexible option for investors of all levels. Goldco also offers dedicated guidance, ensuring a smooth experience from start to finish.

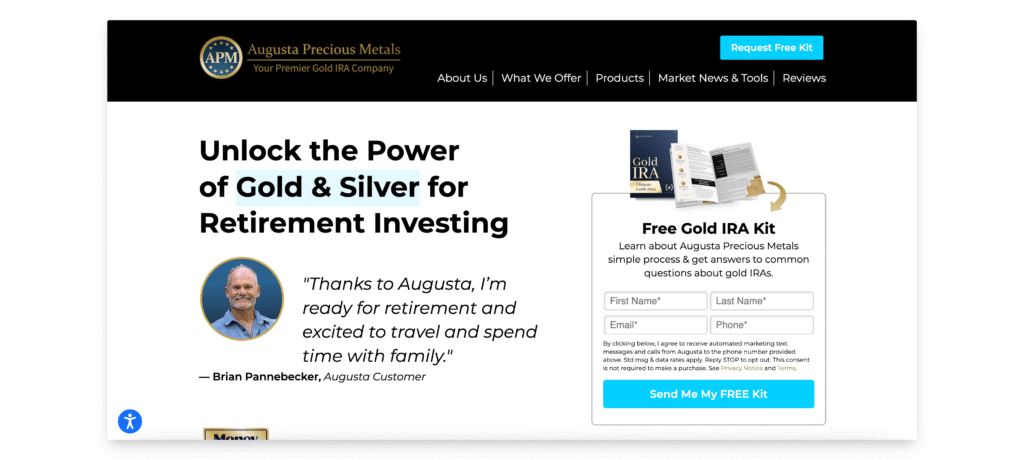

A Closer Look at Augusta Precious Metals

Augusta Precious Metals was founded in 2012 and built its reputation by helping individuals protect their retirement savings through portfolio diversification. One of Augusta’s standout features is its personalized service.

Every client is matched with a dedicated representative who provides one-on-one support. What really impressed me was their strong focus on investor education. They offer a wealth of learning tools, helping clients understand the ins and outs of investing in gold and silver. For anyone new to precious metals, this educational approach can be incredibly valuable.

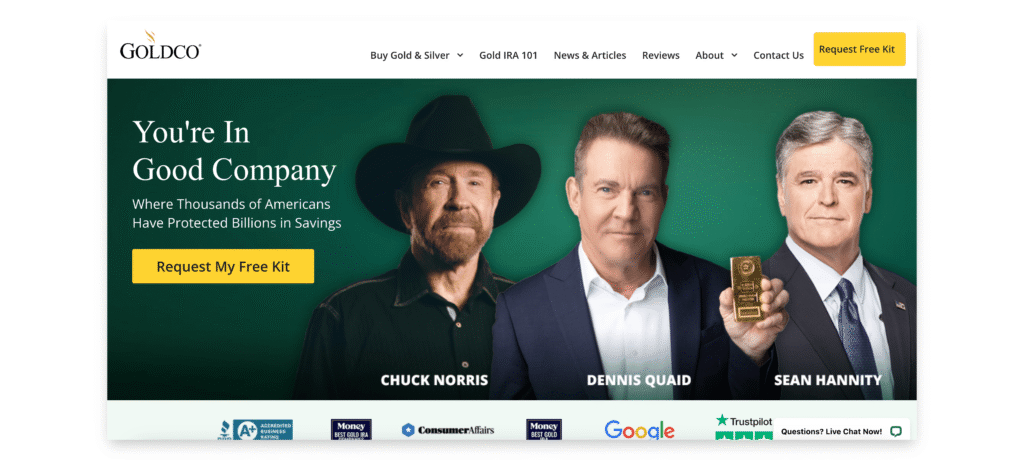

A Closer Look at Goldco

Based in California, Goldco has over a decade of experience guiding clients through the process of adding gold and silver to their retirement portfolios. The team consists of seasoned professionals who take pride in offering consistent, high-quality support. From the initial consultation to opening and funding your account, Goldco makes each step easy to follow. I found their service to be clear, supportive, and thorough. This is ideal for investors who want confidence at every turn.

Brief Summary

Both Goldco and Augusta Precious Metals are excellent choices for those considering a gold or silver IRA, but they cater to slightly different preferences. If you’re looking for an educational, hands-on approach with tailored guidance, Augusta might be the better fit.

On the other hand, if you want a streamlined experience backed by a long-standing company with expert support, Goldco could be the right match. Ultimately, it comes down to the kind of support and experience you value most.

Key Comparison Areas

Goldco and Augusta Precious Metals are both top choices for anyone exploring precious metals as part of their retirement strategy. Each offers gold and silver IRAs, along with the option to purchase physical metals for direct delivery. One notable difference is that Goldco also supports platinum and palladium IRAs, giving investors additional ways to diversify beyond just gold and silver.

1. Customer Support

When it comes to helping clients, both gold IRA companies perform exceptionally well. Goldco has built a reputation for fast, responsive service that many customers find convenient and reassuring. Augusta, in contrast, takes a more hands-on approach. Each investor is partnered with a dedicated customer success agent who offers personalized support.

From my experience with Augusta, this level of attention made a big difference. During my initial consultation, they took time to understand my financial goals, risk tolerance, and overall strategy. The advice they gave felt specific to my needs, which made the process feel more thoughtful and guided.

2. Fee Structures

Both companies are upfront about their fees, which is a plus for transparency. Goldco works with a custodian that charges a flat yearly fee. This makes budgeting simple, regardless of your account size. Augusta follows a tiered fee model, where the cost depends on the amount you invest.

To determine which structure is more cost-effective, consider your investment amount. If you’re putting in a larger sum, Augusta’s scaled fees might work in your favor. However, it really comes down to doing the math based on your specific situation.

3. Educational Resources

Investor education is another area where both firms shine. They offer videos, articles, and other tools to help clients make informed decisions. That said, Augusta takes it a step further with weekly webinars and an extensive knowledge center.

I personally found their webinars to be packed with practical insights. They didn’t just skim the surface, but explained market trends, historical data, and the role of precious metals in a balanced portfolio. This emphasis on learning helped me feel more confident as an investor.

Opening a Gold IRA with Goldco and Augusta: My Experience

Both Goldco and Augusta Precious Metals strive to make the process of setting up a Gold IRA as simple and stress-free as possible. Here’s a look at what the experience was like for me with each company.

Goldco

Getting started with Goldco was straightforward. The initial consultation was handled by a well-informed team member who guided me through each step, from funding the account to selecting precious metals. Their instructions were clear, and the entire process felt well-organized.

What stood out most was their continued support after the purchase. They didn’t just disappear once the sale was done. Anytime I had a question, someone was there to help. That follow-up gave me peace of mind and showed that customer satisfaction really is a priority for them.

Augusta Precious Metals

Augusta offers a more tailored experience. From the beginning, I was assigned a dedicated account representative who walked me through the entire process. One of the highlights was a private web session with a Harvard-trained economist. During the session, they took time to understand my financial goals and investment preferences.

Based on that conversation, they suggested specific strategies and metals that aligned with my needs. What I appreciated most was the long-term support. They’re available to assist well after the account is set up. The personal attention and expert guidance made me feel confident I was making the right choices for my retirement.

Read my full Augusta Precious Metals review to learn more about this company.

Main Takeaways: What Stood Out?

What stood out about Augusta was the personal touch. Their team took the time to understand my goals, clearly explained both the potential rewards and the risks, and offered continued support well beyond the initial setup. The one-on-one guidance made the experience feel thoughtful and tailored.

Goldco impressed me with how knowledgeable the precious metals specialists were. Their team was always patient and never made me feel rushed. Every question I had was answered with care, and they made sure I felt confident at each step of the process.

In the end, the difference came down to style. Augusta felt like a trusted advisor who truly gets to know you, while Goldco offered the steady hand of an experienced professional ready to support you through every phase. Whichever path you choose, you’ll be backed by a company that puts your long-term success first.

Customer Feedback and Ratings

While my personal experience offers one viewpoint, it’s also important to consider what other customers have said about working with Goldco and Augusta Precious Metals.

After reviewing numerous ratings and testimonials and hearing from readers who’ve chosen either company, it’s clear that both firms are held in high regard across the board.

| Review Platform | Augusta Precious Metals | Goldco |

|---|---|---|

| Better Business Bureau (BBB) | A+ Rating, 4.89/5 (92 reviews) | A+ Rating, 4.84/5 (1,193 reviews) |

| BBB Complaints | 0 complaints | 55 complaints |

| Business Consumer Alliance (BCA) | AAA Rating, 5/5 (107 reviews) | AAA Rating, 5/5 (13 reviews) |

| BCA Complaints | 0 complaints | 0 complaints |

| Trustpilot | 4.8/5 (170 reviews) | 4.8/5 (1,596 reviews) |

| Google Reviews | 4.9/5 (549 reviews) | 4.9/5 (2,919 reviews) |

Both companies receive strong marks for customer satisfaction, reflecting their commitment to quality service. Goldco is frequently highlighted for its wide selection of precious metal products and flexibility. Customers often mention how easy the buying process is and appreciate the consistent communication from the team.

Augusta, on the other hand, is regularly praised for its highly personalized support. Many clients point out how educational and informative their consultations were, often crediting the company for helping them understand complex investment topics with ease.

So What is the Best Gold IRA Company?

Deciding between Goldco and Augusta Precious Metals isn’t always easy. Both companies are highly respected and offer strong benefits, but they cater to slightly different needs.

- If you’re planning to invest a larger amount and want access to a wider range of precious metals, Augusta Precious Metals could be the better match.

- However, if your investment budget is more modest, Goldco may be a more comfortable fit for you.

In the end, it all depends on what you’re looking for and what suits your financial goals. The good news? No matter which one you choose, you’ll be working with a trustworthy company that has a strong track record of customer satisfaction.

Other Things to Keep in Mind

- Location: Both companies are based in California, so there’s no major advantage in terms of physical location.

- Minimum Investment: Goldco stands out here. It doesn’t require a minimum investment, which makes it easier for beginners or those with smaller budgets to get started. In contrast, Augusta requires at least $50,000 to open an account, which may be too high for some investors.

- Storage Choices: Each company offers secure storage solutions. Goldco has its own private facility for non-IRA metals and gives you access to three other storage providers. Augusta works with Brink’s, a trusted name worldwide in secure storage and transport.

- Retirement Account Options: Both companies support gold and silver IRAs. That said, Goldco has the added advantage of offering platinum and palladium options too—ideal if you want to diversify beyond just gold and silver.

Taking all of this into account, will help you choose the company that matches your needs best. Ultimately, your choice will depend on your personal investment goals. While both companies provide excellent service, the best company for you will be the one that aligns with your portfolio needs.